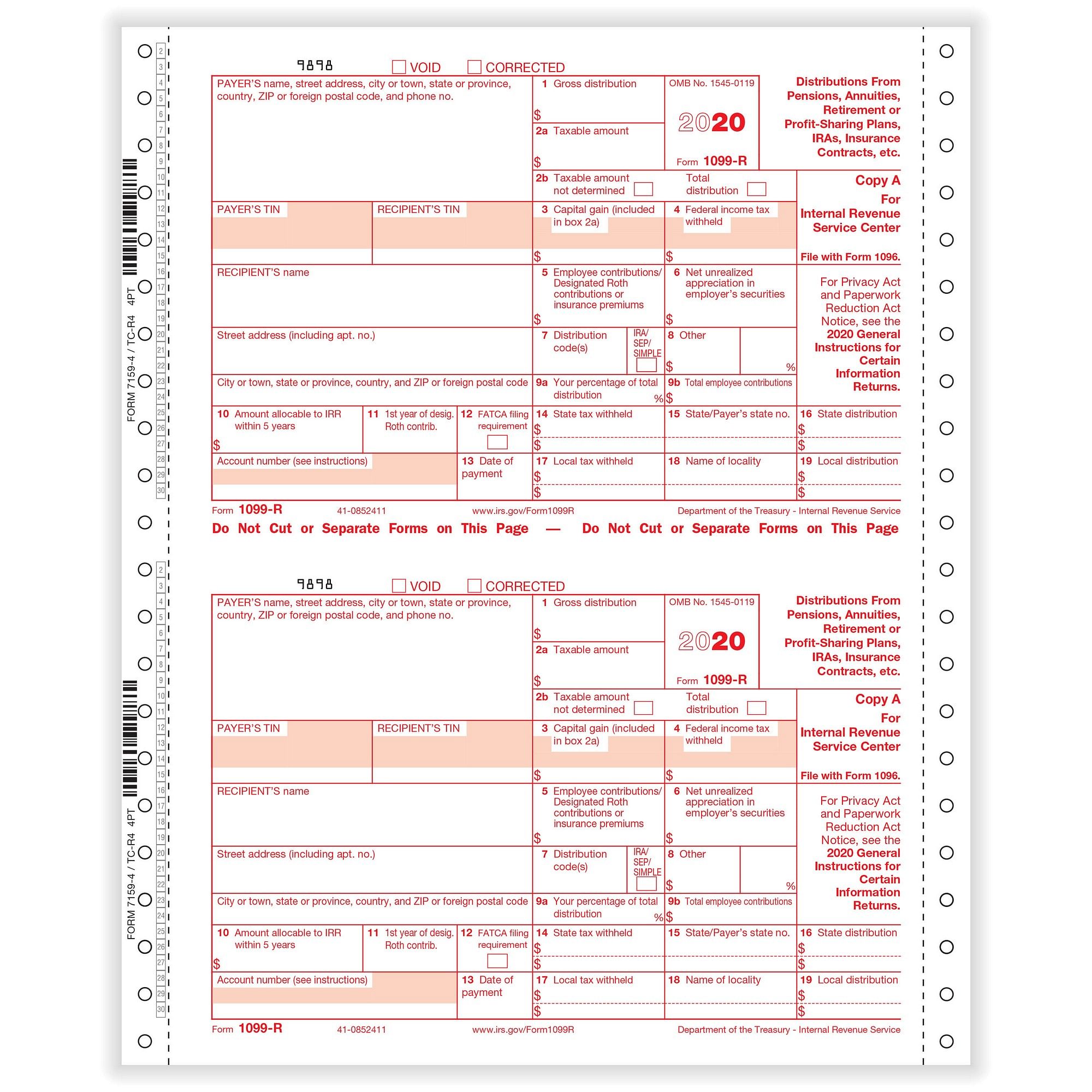

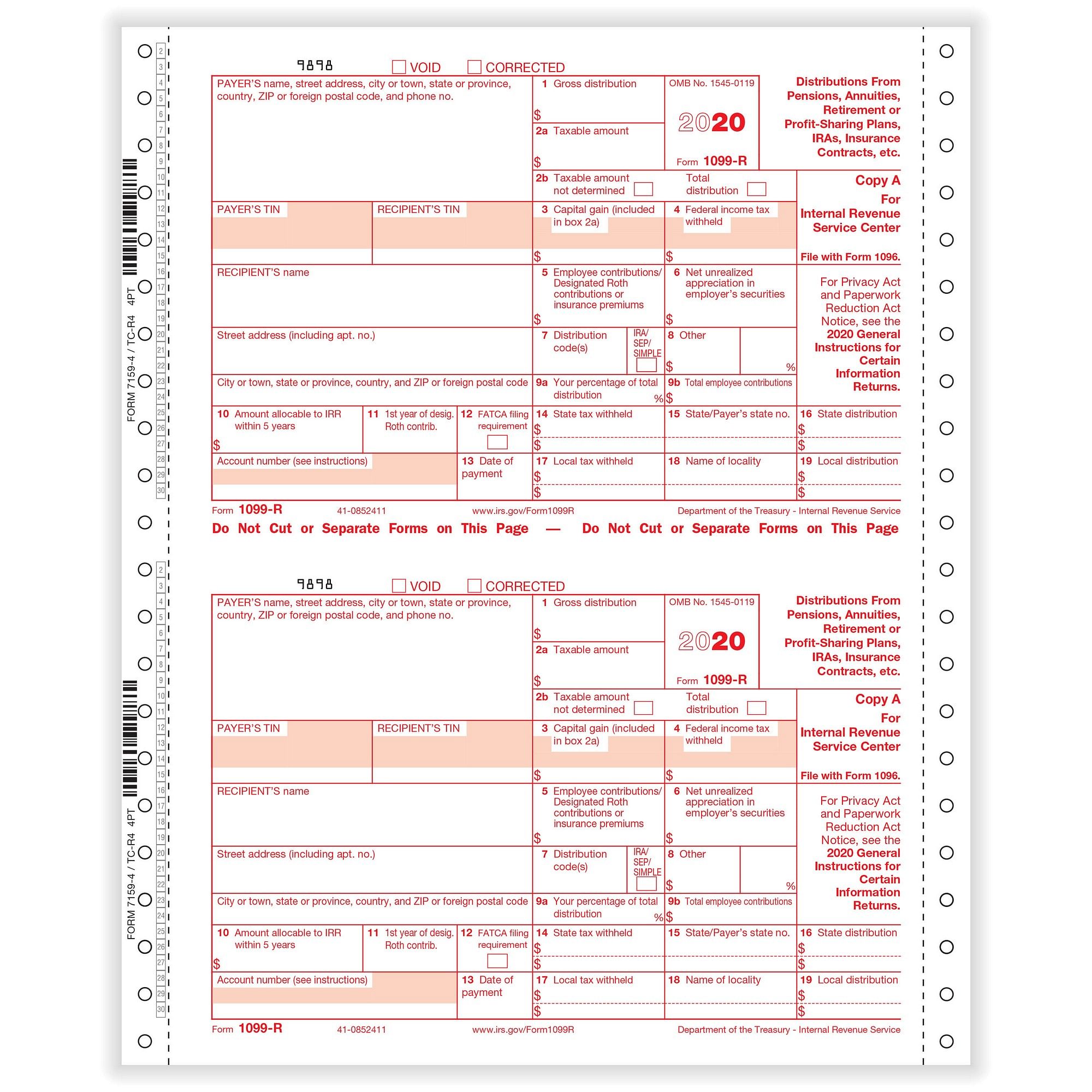

Form RRB-1099-R for Individuals Taxed as United States Citizensįorm RRB-1099-R is the tax statement that documents the pension components of the railroad retirement annuity for U.S.The Employee Contribution (ECC) amount.The claimed country of residence for tax purposes.

#Rrb 1099 r code

Income Code 99 - Indicates the amounts on this statement represent pension payments.Income Code 98 - Indicates the amounts on this statement represent social security equivalent benefit payments.The following amounts are shown for the designated taxable year: Form RRB-1042S for Individuals Taxed as Nonresident Aliensįorm RRB-1042S is the tax statement that documents the Social Security Equivalent Benefit (SSEB) portion and Non-Social Security Equivalent Benefit (NSSEB) portion of Tier 1, Tier 2, Vested Dual Benefit (VDB), supplemental annuity payments and special guaranty benefits paid and repaid to nonresident aliens of the United States, and the related U.S.Medicare premiums deducted from annuity payments.The offset amounts are included in the SSEB amounts shown as paid. Workers' compensation offset amounts deducted from the SSEB portion of tier I.The portion of the total SSEB payments paid for the third and earlier prior tax years.The portion of the total SSEB payments paid for the second prior tax year.

The portion of the total SSEB payments paid for the first prior tax year. Net SSEB payments (total payments minus total repayments). Note - Tier I repayments for the period prior to December 1985 (the payment dated January 1, 1986) may be reported as SSEB repayments even though the Tier 1 payments were never reported to the IRS as taxable payments. The following amounts are shown on Form RRB-1099 for the designated taxable year: citizens.įor information about if and/or how SSEB payments, repayments, and tax withholding amounts should be reported to the Internal Revenue Service, refer to IRS Publication 915, Social Security and Equivalent Railroad Retirement Benefits. Form RRB-1099 for Individuals Taxed as United States Citizensįorm RRB-1099 is the tax statement that documents the Social Security Equivalent Benefit (SSEB) portion of tier I regular annuity payments and special guaranty payments for individuals taxed as U.S. Differences may be attributable to deductions applied to annuity payments, such as Medicare premium deductions or Federal income tax withholding. The totals reported on RRB tax statements may not equal the total amount of railroad retirement annuity payments actually received by the beneficiary during the tax year. Recovery of RRB Unemployment and Sickness Insurance overpayments from RRA annuity payments should be shown on RRB Unemployment and Sickness Insurance tax statements. Recovery of SSA overpayments from RRA annuity payments should be reflected on tax statements issued by the Social Security Administration. Repayments shown on RRA tax statements represent recovery of RRA annuity overpayments only. If a corrected tax statement is received, the original tax statement for that same period should not be used when filing a tax return. See item 2 for descriptions of this form.Įach tax statement received should be considered when filing an income tax return. For instance, if an individual is a NRA of the United States and the rate of tax withholding changed, or the country of legal residence changed, they may receive more than one Form RRB-1042S. Individuals may receive more than one tax statement for a given time period, depending on the type of payments made. The RRB also provides this information to the IRS. The annual tax statements, as appropriate, reflect RRA annuities paid, RRA annuities repaid, the total amount of Federal income taxes withheld, the EEC amount, the rate of NRA tax withholding, and a NRA's country of bona fide residence for the taxable year.

The portion of the total SSEB payments paid for the first prior tax year. Net SSEB payments (total payments minus total repayments). Note - Tier I repayments for the period prior to December 1985 (the payment dated January 1, 1986) may be reported as SSEB repayments even though the Tier 1 payments were never reported to the IRS as taxable payments. The following amounts are shown on Form RRB-1099 for the designated taxable year: citizens.įor information about if and/or how SSEB payments, repayments, and tax withholding amounts should be reported to the Internal Revenue Service, refer to IRS Publication 915, Social Security and Equivalent Railroad Retirement Benefits. Form RRB-1099 for Individuals Taxed as United States Citizensįorm RRB-1099 is the tax statement that documents the Social Security Equivalent Benefit (SSEB) portion of tier I regular annuity payments and special guaranty payments for individuals taxed as U.S. Differences may be attributable to deductions applied to annuity payments, such as Medicare premium deductions or Federal income tax withholding. The totals reported on RRB tax statements may not equal the total amount of railroad retirement annuity payments actually received by the beneficiary during the tax year. Recovery of RRB Unemployment and Sickness Insurance overpayments from RRA annuity payments should be shown on RRB Unemployment and Sickness Insurance tax statements. Recovery of SSA overpayments from RRA annuity payments should be reflected on tax statements issued by the Social Security Administration. Repayments shown on RRA tax statements represent recovery of RRA annuity overpayments only. If a corrected tax statement is received, the original tax statement for that same period should not be used when filing a tax return. See item 2 for descriptions of this form.Įach tax statement received should be considered when filing an income tax return. For instance, if an individual is a NRA of the United States and the rate of tax withholding changed, or the country of legal residence changed, they may receive more than one Form RRB-1042S. Individuals may receive more than one tax statement for a given time period, depending on the type of payments made. The RRB also provides this information to the IRS. The annual tax statements, as appropriate, reflect RRA annuities paid, RRA annuities repaid, the total amount of Federal income taxes withheld, the EEC amount, the rate of NRA tax withholding, and a NRA's country of bona fide residence for the taxable year.  Nonresident alien (NRA) tax statements are to be released by March 15 of the year following the close of the tax year. citizen tax statements are to be released by January 31 of the year following the close of the tax year.

Nonresident alien (NRA) tax statements are to be released by March 15 of the year following the close of the tax year. citizen tax statements are to be released by January 31 of the year following the close of the tax year.

The Internal Revenue Code requires the RRB release annual tax statements of annuities paid and/or repaid in a given tax year.

0 kommentar(er)

0 kommentar(er)